Most people will know Chess as a Sage 200 partner. We have been providing Sage 200 products and services for around 15 years. In June 2022, we made the strategic decision to introduce Sage Intacct to our product portfolio.

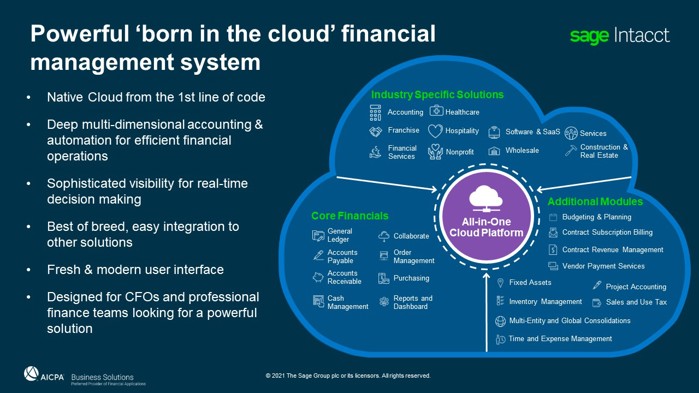

Sage Intacct is a best-of-breed, born in the cloud financial management application. While this product is relatively new in the UK, it has a great heritage in the US going back to 1999.

What is Sage Intacct?

It is a powerful financial management system that helps finance professionals increase efficiency and drive growth for their organisations by automating their processes to run their day-to-day business better. By giving greater insight and flexibility, these businesses can make confident long-term decisions, then act fast to execute changes.

Sage Intacct has a solid financial core that uses deep, multi-dimensional accounting and automation for efficient financial operations, using AI technology to elevate the work of humans. In addition, it has best-of-breed, easy integration to other solutions you use to run your business to create a true digital workflow. This results in sophisticated visibility with real-time dashboards, enabling better informed, business-critical decisions.

Sage Intacct helps forward-looking CFOs and finance executives access integrated management and financial reports across multiple business entities - in minutes, not days, to grow and drive their businesses.

Automating The Finance Process with Sage for Education

On Demand Webinar

Sage Intacct v Sage 200

As a growing business, you might think, why Intacct and not Sage 200? This is a valid question to ask, and it depends on the requirements. As a Sage Value Added Reseller, we can help you to answer that question as it is usually different from business to business.

Here are some things to consider which would suggest Intacct would be the right fit:

- You have an increase in transactions (>1.5m) in the system

- You are experiencing business growth and need to provide more employees with user access

- You need to allocate permission-based roles for users

- You are expanding into other countries outside of your current territory

- You have increasingly complex business processes

- You need to consolidate disparate systems and multiple entities

- You need to execute more advanced management reporting and BI

- You want to access data on the go via a cloud native solution

- You want to manage your finance function remotely

- You want better visibility and control over financial periods

- You need to eradicate high IT and Infrastructure costs

- You need advanced handling of foreign currency, tax and legislation

If you think this looks like you or where you might be in the 12-18 months, then maybe Intacct is the product you should be exploring.

My advice would be to take up a free consultation with our Team here at Chess, who can discuss your situation and requirements and help you make the best decision for your business.

So, to summarise, the future of finance is digital. Using secure digital networks, transactions will flow through business systems such as Sage Intacct and Chess are at the forefront with our partners Sage.

Hopefully, you managed to attend our FIT Conference this year to hear Sage CTO Aaron Harris talk about the future of finance and how Sage is empowering businesses to transform their business functions. This session is now available on demand here.

About the author

uSkinned

uSkinned, the world’s number one provider of Umbraco CMS themes and starter kits.